Written by Monal Mehta On September 25th 2019, Rutgers iJOBS held an Equity Research Simulation event. Two individuals, both from Guggenheim Securities, LLC, came down from NYC for the evening to give students more insight on what an equity research career might entail. The first speaker, Charles Zhu, Ph.D., is an Equity Research Senior Associate covering small- and mid-cap Biotechnology stocks with a focus in oncology. Before obtaining this position, Dr. Zhu worked as a biopharmaceutical market access and strategy consultant at The Dedham Group. Dr. Zhu is a Rutgers Alumni, with a PhD in Biomedical Engineering from Rutgers University – New Brunswick! The second speaker, Anvita Gupta, Ph.D., is an Equity Research Associate covering Rare Diseases and Gene Therapy cap names in the Biotechnology sector at Guggenheim Securities. Before this position, Dr. Gupta earned her PhD in Microbiology and Immunology from New York Medical College in 2018, followed by a Credential of Readiness certification in Business Analytics, Economics for Managers and Financial Accounting from Harvard Business School Online.  Before the simulation, iJOBS attendees were able to ask Dr. Zhu and Dr. Gupta questions about their careers. One of the initial questions was “What is equity research?” Dr. Zhu described the field as a team of analysts and associates that evaluate publicly traded companies, such as biotechnology companies, in order to give a pitch to investors, wealth managers, hedge funds, etc. that might have funds to put into stock. Other than Guggenheim Securities, there are many other firms, including Evercore, Bank of America, etc.! Dr. Gupta then went on to describing the interview process. “The interview process started with a phone interview, followed by an in person interview with the analyst and a co-worker, which was then followed up by an assignment requiring me to create a slide deck on a drug for a particular diseases… in total there were about 6 rounds of interviews, but after about 3 rounds you knew where the interviews were headed.” Dr. Zhu also shared his experiences, and wanted guests to know that as an interviewee you should have an idea of what equity research is, demonstrate you can act and work fast, but that it is not super important to know finance – the science is more important, and the financial knowledge will come while doing the job. It is also important to know that an entry level position has the official title of “Equity Research Associate” while a more senior position is the “Analyst.” If you get hired as an equity research associate you will have to complete 4 licensing exams (on topics such as finance, compliance, regulation) within the first year of working. Until you pass all exams, you are not granted authorship on notes, cannot talk to clients, and cannot speak publicly. So, it is very important to complete and pass all exams! Dr. Zhu described the exams as time consuming to study for, however if you put in the effort you should be able to pass. As a final note on the job description, both speakers mentioned they get to the office very early each day, 7 A.M., or 7:10 A.M. at the latest, and are expected to work ~12-hour days. While this seems daunting coming from a graduate school-work day, there is no weekend/after-hours work, and the job comes with a 6-figure salary! After the initial Q/A session, we moved on to the simulation portion of the evening. Here, the goal was to compare 2 cancer drugs targeting Gastrointestinal Stromal Tumors (GIST), from two different pharmaceutical companies, Deciphera Pharmaceuticals and Blueprint Medicines. We were given press releases from both companies on their drug, Ripretinib from Deciphera, and Avapritinib from Blueprint. We were then asked to compare and contrast the two drugs and answer the following questions.

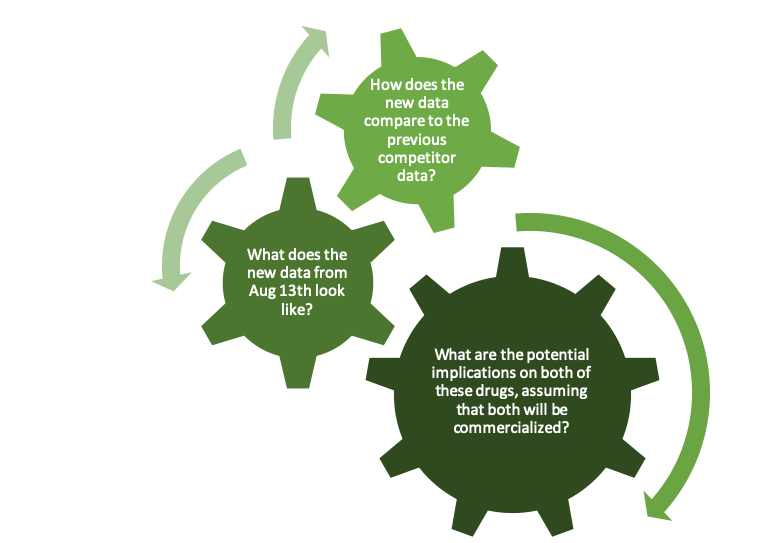

Before the simulation, iJOBS attendees were able to ask Dr. Zhu and Dr. Gupta questions about their careers. One of the initial questions was “What is equity research?” Dr. Zhu described the field as a team of analysts and associates that evaluate publicly traded companies, such as biotechnology companies, in order to give a pitch to investors, wealth managers, hedge funds, etc. that might have funds to put into stock. Other than Guggenheim Securities, there are many other firms, including Evercore, Bank of America, etc.! Dr. Gupta then went on to describing the interview process. “The interview process started with a phone interview, followed by an in person interview with the analyst and a co-worker, which was then followed up by an assignment requiring me to create a slide deck on a drug for a particular diseases… in total there were about 6 rounds of interviews, but after about 3 rounds you knew where the interviews were headed.” Dr. Zhu also shared his experiences, and wanted guests to know that as an interviewee you should have an idea of what equity research is, demonstrate you can act and work fast, but that it is not super important to know finance – the science is more important, and the financial knowledge will come while doing the job. It is also important to know that an entry level position has the official title of “Equity Research Associate” while a more senior position is the “Analyst.” If you get hired as an equity research associate you will have to complete 4 licensing exams (on topics such as finance, compliance, regulation) within the first year of working. Until you pass all exams, you are not granted authorship on notes, cannot talk to clients, and cannot speak publicly. So, it is very important to complete and pass all exams! Dr. Zhu described the exams as time consuming to study for, however if you put in the effort you should be able to pass. As a final note on the job description, both speakers mentioned they get to the office very early each day, 7 A.M., or 7:10 A.M. at the latest, and are expected to work ~12-hour days. While this seems daunting coming from a graduate school-work day, there is no weekend/after-hours work, and the job comes with a 6-figure salary! After the initial Q/A session, we moved on to the simulation portion of the evening. Here, the goal was to compare 2 cancer drugs targeting Gastrointestinal Stromal Tumors (GIST), from two different pharmaceutical companies, Deciphera Pharmaceuticals and Blueprint Medicines. We were given press releases from both companies on their drug, Ripretinib from Deciphera, and Avapritinib from Blueprint. We were then asked to compare and contrast the two drugs and answer the following questions.  Dr. Zhu explained that often when two competing companies release similar drugs, he will have to write up reports explaining what happened, and the potential impact of the drugs on stocks. This can be a very fast paced field. He went on to give us an example, “One morning I missed my bus from Port Authority, and my co-worked had just texted me about a press release that had been dropped at 7 A.M., there was no time to waste so I had to run all the way to the office. By 8 A.M. had the report sent to my boss for his revisions! When news hits, it is important for us to get the report out as soon as possible.” This simulation lasted about 40 minutes and gave us insight into the little time that might be available for a report to be written up. As someone who is not in the cancer field, and is not used to reading about drug reports, the simulation was not easy. We had to decode clinical and drug related jargon to figure out which drug might be the best, and lead to the most market success. While challenging, it was a very stimulating and exciting to work under “pressure” to get a report out. If you missed the event and would like to recreate the stimulation on your own time, you can follow these links to get the information on both drugs: Avapritinib and Ripretinib. Overall this was a very interesting stimulation. We, in the audience, were able to ask questions about what equity research entails, and participate in an activity allowing us to determine if this field might be one to look into while hunting for jobs. In my opinion, the amount of job opportunities available to a Ph.D. scientist can seem endless at times, so attending iJOBS events covering different careers can be helpful when trying to narrow down the list. If you are like me, and haven’t narrowed down your career interests, consider attending iJOBS events to get more knowledge. To find a full list of iJOBS events, click here, the page is updated regularly so check back often! Junior Editor: Jennifer Casiano-Matos

Dr. Zhu explained that often when two competing companies release similar drugs, he will have to write up reports explaining what happened, and the potential impact of the drugs on stocks. This can be a very fast paced field. He went on to give us an example, “One morning I missed my bus from Port Authority, and my co-worked had just texted me about a press release that had been dropped at 7 A.M., there was no time to waste so I had to run all the way to the office. By 8 A.M. had the report sent to my boss for his revisions! When news hits, it is important for us to get the report out as soon as possible.” This simulation lasted about 40 minutes and gave us insight into the little time that might be available for a report to be written up. As someone who is not in the cancer field, and is not used to reading about drug reports, the simulation was not easy. We had to decode clinical and drug related jargon to figure out which drug might be the best, and lead to the most market success. While challenging, it was a very stimulating and exciting to work under “pressure” to get a report out. If you missed the event and would like to recreate the stimulation on your own time, you can follow these links to get the information on both drugs: Avapritinib and Ripretinib. Overall this was a very interesting stimulation. We, in the audience, were able to ask questions about what equity research entails, and participate in an activity allowing us to determine if this field might be one to look into while hunting for jobs. In my opinion, the amount of job opportunities available to a Ph.D. scientist can seem endless at times, so attending iJOBS events covering different careers can be helpful when trying to narrow down the list. If you are like me, and haven’t narrowed down your career interests, consider attending iJOBS events to get more knowledge. To find a full list of iJOBS events, click here, the page is updated regularly so check back often! Junior Editor: Jennifer Casiano-Matos

iJOBS Blog