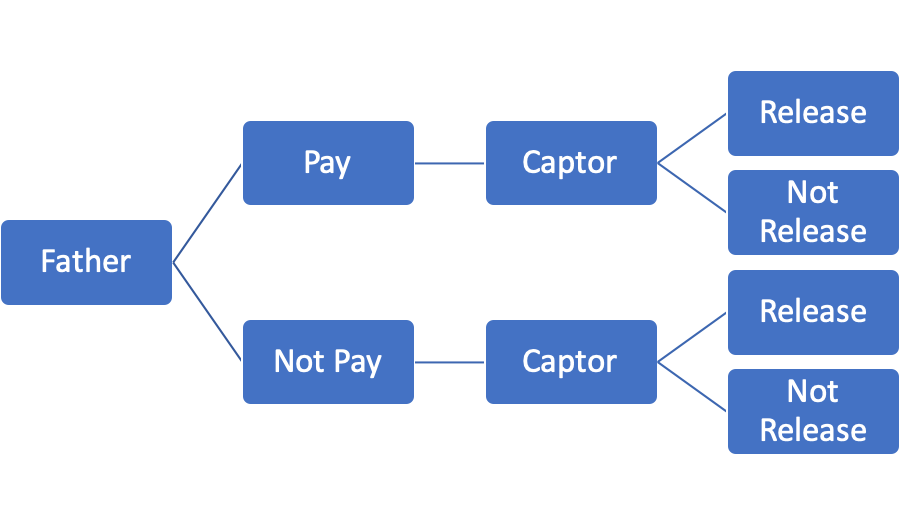

By Vinam Puri Ever since I found out about the area of Mergers and Acquisitions, especially in the Pharma and Biotech Industry, I became very interested in exploring it. I learned about M&A in a session held during the MiniMBA in BioPharma Innovation and when I found out that iJOBS was holding an event about it, and that it was actually going to be an interactive game, I signed up right away to reinforce my learnings in an entirely different setting. The event called “Mergers and Acquisitions in Pharma: An Interactive Game” was conducted by Dr. Douglass J. Miller from Rutgers Business School. I have to admit, I had a lot of fun in this event as it strengthened my inclination towards the business side of the pharmaceutical industry. The game began with the projection of a trailer of the movie, Ransom, which laid down the foundation for the example that Dr. Miller used to explain how the game would be played.  The example used a scene of the movie where the son was kidnapped and how the actions of either party could lead to several scenarios which would determine how the story would further unfold. Each party would plan a step with an assumption of the next step by the other party. This was our introduction to the Nash Equilibrium game theory, which is that each player makes a move taking into account the other players move while their move remains unchanged. Keeping this easy and unforgettable example in mind, we were then given a scenario of two big corporations, Mega Corp and Grande Inc., who were trying to bid to acquire a smaller company. We worked in teams while being one of the two companies and drawing the scenario of the bidding process within the framework of certain rules. At the end of the game, we were told to announce our moves, one side at a time. This led to the decision of which corporation won the bidding. By means of this game, we were able to understand how different the values could be for the same thing in different minds. “Value is in the Eye of the Beholder” The two corporations in the example would value the same potential business to be acquired differently, and that would be based on their calculations, their experience, their financial conditions, their risk aversion, and many other factors. We also understood the impact of the potential risks in this industry, since the value of an investment could be based on past performance or the promise of success. However, that could drastically change if a product in Phase III clinical trials fails or does not get FDA approval. Another concept was that it is easy for someone to overvalue an investment based on their own criteria, like one of the teams did in the game where they valued the company 2-3 times more than all other teams. Another challenge is that only a range can be estimated and that could be very subjective. After the game concluded, there was a brief discussion about some of the major recent mergers and acquisitions such as the Takeda takeover of Shire in 2018. There were some additional readings provided to learn from some other recent M&As. One particular book that I would like to pass on to you – Barbarians at the Gate by Bryan Burrough and John Helyar, based on a true story. There is also a movie based on it by the same name. If you end up reading it or watching the movie, please leave some comments below to share your experience. This article was edited by Helena Mello and Eileen Oni.

The example used a scene of the movie where the son was kidnapped and how the actions of either party could lead to several scenarios which would determine how the story would further unfold. Each party would plan a step with an assumption of the next step by the other party. This was our introduction to the Nash Equilibrium game theory, which is that each player makes a move taking into account the other players move while their move remains unchanged. Keeping this easy and unforgettable example in mind, we were then given a scenario of two big corporations, Mega Corp and Grande Inc., who were trying to bid to acquire a smaller company. We worked in teams while being one of the two companies and drawing the scenario of the bidding process within the framework of certain rules. At the end of the game, we were told to announce our moves, one side at a time. This led to the decision of which corporation won the bidding. By means of this game, we were able to understand how different the values could be for the same thing in different minds. “Value is in the Eye of the Beholder” The two corporations in the example would value the same potential business to be acquired differently, and that would be based on their calculations, their experience, their financial conditions, their risk aversion, and many other factors. We also understood the impact of the potential risks in this industry, since the value of an investment could be based on past performance or the promise of success. However, that could drastically change if a product in Phase III clinical trials fails or does not get FDA approval. Another concept was that it is easy for someone to overvalue an investment based on their own criteria, like one of the teams did in the game where they valued the company 2-3 times more than all other teams. Another challenge is that only a range can be estimated and that could be very subjective. After the game concluded, there was a brief discussion about some of the major recent mergers and acquisitions such as the Takeda takeover of Shire in 2018. There were some additional readings provided to learn from some other recent M&As. One particular book that I would like to pass on to you – Barbarians at the Gate by Bryan Burrough and John Helyar, based on a true story. There is also a movie based on it by the same name. If you end up reading it or watching the movie, please leave some comments below to share your experience. This article was edited by Helena Mello and Eileen Oni.

iJOBS Blog