By Natalie Losada

Imagine you had an expired tube of topical antibiotic (truthfully, most of us currently do) and you needed to decide if you should throw it away or give it to a friend who needs to use it. It’s an easy decision, right? You only need to consult yourself and possibly your friend, and if you decide to throw it away you have only lost a few dollars.

Now imagine you own a pharmaceutical company and millions of dollars of products are about to expire. What do you do? Panic? Yes, probably at first, but you will quickly call on your business development (BD) team to evaluate all the available options and perform their due diligence. While some companies have in-house BD support, others outsource the task, but the goal remains the same; save the company money.

This iJOBS event in January 2023 was led by Evelyn Chang and focused on this specific case study where a company had to decide the best course of action with their soon-to-expire inventory. Evelyn has led multiple events for iJOBS to educate students and postdocs on business development as a career. This year, Evelyn joined us virtually from North Carolina, where she is currently in the semiconductor industry, working in business development at Cree LED.

Evelyn Chang’s Background

Before diving into the world of business management and the case study, we learned about Evelyn’s career journey. She grew up in New Jersey and went to NJIT for her BS in computer engineering and then her MS in pharmaceutical engineering. She later earned an executive MBA from Rutgers business school with concentrations in finance, strategy, and leadership. As of this year, Evelyn has 20 years of experience in the regulated life science (pharmaceutical and medical device) and semiconductor industry. While still working in pharmaceuticals, Evelyn was encouraged by a previous coworker to join the mergers and acquisitions (M&A) team at Cree LED. Outside of her work, she’s a mom of two, owner of a cake decorating business, and co-founder/owner of a startup tech company. She’s a busy bee living a “hectic” life, as she put it.

What is Business Development?

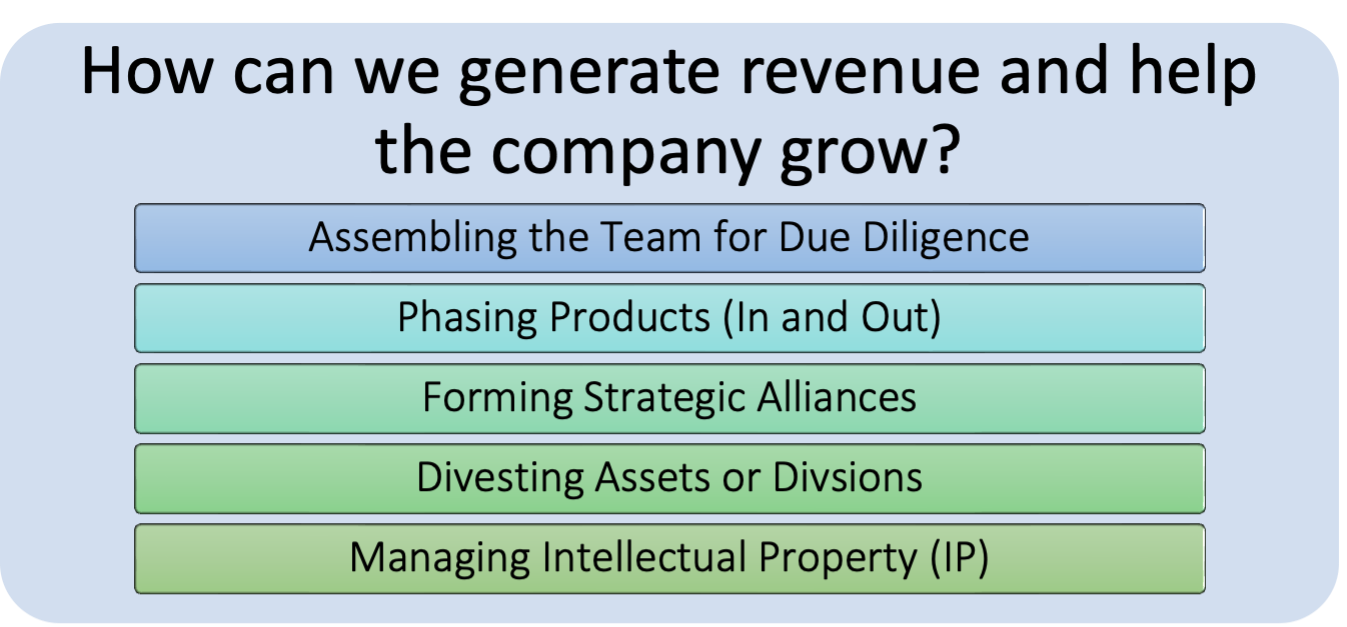

Evelyn began defining BD by the five focus areas of a BD employee/team (Figure 1). The first area of focus she mentioned was recruiting people to the management team for due diligence tasks, which may involve bringing in an outside company for their expertise. Due diligence is when you ensure purchases and business decisions are thoroughly vetted before the company takes any action. For example, if a company is thinking of acquiring an asset, due diligence would involve researching the product, profit, competitors, and more to determine if purchasing that asset will be worthwhile and makes sense with the executives’ long-term plan for the company. The BD team also advises the company on when to phase products in and out of production or specific markets. For example, if a product is not producing revenue in its current market, it may need to be phased out (end production and marketing). The next area BD focuses on is forming strategic alliances. For example, an alliance/joint venture with a complementary company can be profitable and productive if a startup lacks certain assets or technical expertise. Along the same lines as alliance forming, BD will also advise their own company on identifying and acquiring other companies that may benefit the company’s long-term goals. The last two areas of focus were divesting assets or divisions and managing intellectual property. Evelyn also reinforced that business development is very broad and can be boiled down to a simple statement of responsibility: how can we generate revenue and help the organization grow?

Figure 1: Visual representation of focus areas of Business Development (BD) team and their mission statement/question.

Business Development Approach and Tools

BD teams utilize a high-level approach consisting of Vision, Strategy and Execution, and Commercialization, to steer their work. Vision is listed first because, ultimately, the short-term and long-term goals of the company executives guide the BD team in developing their plan, strategy, and execution. In short, BD is centralized around managing assets, both current and those that could potentially be acquired. Following the explanation of BD, Evelyn then walked us through the tools they use to know if a product or company is worth purchasing/investing in. There are three categories: financial statements, market research, and financial ratio analysis, wherein multiple resources and factors are considered. Within each category there are multiple resources and factors to consider before making any decision.

Financial statements

Balance sheet:

- Assets: these include current, fixed, and intangible (copyrights, trademarks, etc.) assets

- Liabilities: current and non-current (if or how much another company owes)

- Equity: paid-in-capital (cash received from stocks) and retained earnings (profit after paying all operating costs and dividends to shareholders)

- Assets = Liabilities + Equity

- A company may have good intangible assets (exclusivity to sell) but if they have a lot of debt and low retained earnings, their assets won’t be worth much to your company and you should not invest.

Income statement:

- Net income = (Total Revenue + Gain) – (Total expenses + Losses)

- Investment in the company will be considered if the net income is high.

Cash flow statement:

- Operating activities: are they spending a lot on operations?

- Financing activities: is their high financing (“taking a lot of the load”)?

- Investment activities: what are they investing in and are they investing a lot?

- Net Profit Value (NPV): if positive and higher than other companies, you can pursue, and if it’s negative, it’s not worth the investment.

- You can go to a public company’s investment page on their website and see their 10-K, which describes their financial performance.

Market research:

- ROI (return on investment): do your own due diligence to see if it’s worth investing in a particular company. Generally, 10% or more is acceptable. You can then rank companies with 10% or more ROI to pick the best option.

- Niche: understand if this is a niche product that will fade over time. Also decide if you want to risk investing in a niche product and try to make revenue before it fades away.

- Disruptors: supply chain disruptions are an example, if a pandemic or a war or a particular material shortage is happening, you might not want to invest in a company that will be hindered by these disruptors.

Financial ratio analysis:

- Liquidity ratio: how fast a company liquidates their assets (turns their products into cash). This has an impact on financial stability.

- Working Capital ratio: how fast and how much money you are spending on capital.

- Asset Usage ratio: calculated as the total revenue for all the products the company currently owns.

- Efficiency ratio: how well a company uses its resources.

- Profitability ratio: a company’s ability to generate earnings.

BD team members work together to evaluate a product or company using the above-listed tools and determine if it is worth the investment. The ratios are particularly helpful for numerous reasons: you can compare companies of different sizes and industry types and you can obtain performance trends (growth or deterioration). However, one must also know their limits. The calculations are only as good as the input data, so if things are not well reported, you will not have a good summary of the company’s performance.

To understand all the BD terms, Evelyn recommends formal training. For her, the ratios concept was the hardest to learn as the zero or negative values were difficult to interpret. Evelyn went to Rutgers for her business degree, but she also mentioned there are online options, like Coursera and Udemy, if that fits your schedule better. Another great way to learn about BD is to read and practice solving case studies. In this iJOBS event, we did just that, and as you read the next section you can practice working with a case study too.

You are part of the BD team in a pharmaceutical startup (New Jersey) that has been around for 10 years. Because of emerging competition and the war in Ukraine, the startup is experiencing supply chain issues and losing money. The company’s excess inventory is near expiring (about a year), and your operating income has been reduced, so you must conserve cash. Your task is to assess how to make a profit on the products you already have.

Expired products would need to be disposed of, which involves writing them off as a loss and, if necessary, paying fees for proper disposal, like pharmaceutical drugs. Another option Evelyn mentioned is donating to hospitals and clinics (nationally) to get government credit. International donations would need additional approvals and require longer shipping times, so the products could expire before they reach the destination. Ideally, you want to find a way to get revenue without disposing of or donating your products. If you are an experienced BD team member, you might have considered what Evelyn did: can we sell our human pharmaceutical product in the veterinary market? As an example, acetaminophen is used in both humans and animals. The idea is to look for a quick solution because starting a whole new drug application (NDA) will take at least 6 months for approval, while the products expire in approximately a year.

Sequence of activities (as performed and recommended by Evelyn Chang):

FIRST: Assess existing inventory:

- Prepare a list of the expiring pharmaceutical finished goods. This should contain product details like dosage, dosage form, strength, size, cost/unit, etc.

- You can take this time to reference the orange book from the FDA, which contains all the information on FDA-approved drug products for humans.

SECOND: Review the FDA green book:

- The green book contains information on FDA-approved drug products for animals. If you want to sell your human drug to the veterinary industry, you have to cross-reference to find an equivalent drug in both the green and orange books.

- The orange and green books contain information like market status (e.g., Rx, over-the-counter), application number, dosage form, route of administration, strength, applicant holder, etc. Cross-check everything relevant to your product.

- Make sure to understand regulatory requirements before proceeding, including active ingredients, strength and dosage form, dosage regimen (including the route of administration), and labeling (generic labeling must match the brand name labeling exactly).

- You should look for and compare exclusivity, competitors, labeling, etc., in the green book. You need to understand the market you are entering so you don’t infringe on another patent or sell something with many competitors.

- Tip: look for expired (A)NDAs ([abbreviated] new drug applications) because that company will no longer have exclusivity to sell, and you can make/sell a generic. In the green book, they are called ANADAs (abbreviated new animal drug applications).

THIRD: Conduct competition analysis:

- Perform a market share analysis (remember the market research terms and tools from the previous section). IQVIA is a great resource for understanding a company’s position in the current market. IQVIA does market research for you and writes summary reports. You can subscribe to get their market research analysis on-demand.

FOURTH: Perform financial analysis:

- Calculate the NPV (remember it’s part of the cash flow statement!) and determine how much competitors are selling versus how much your company is selling (or has left in their inventory).

FIFTH: Make a list of assumptions:

- The assumptions can include “pet owners are willing to pay cash” and “the FDA ANADA will be processed within 6 months”. These are things you assume will work in your favor to maximize your profit in this plan.

Spreadsheets should be your best friend for organizing the above data and making quick comparisons and conducting deep analysis. This is especially important since employees from different departments need to provide feedback about the logistics and feasibility of the available options. The BD team was given three weeks to compile the initial report, which involved filtering lots of information from big spreadsheets, contacting various people to answer specific questions, and inquiring about different options the company had left. Because of their extensive research, they discovered human drugs cannot be sold for animal usage without performing clinical studies, according to the FDA. In the end, the company donated the products to charities and several hospitals for government credit at a significant loss to the company.

While the company in this case study had to choose a less-than-ideal option, the BD team still had to complete their due diligence by researching and evaluating all possible options the company had. Sometimes research in graduate school can feel the same, where a lot of work has been done to seemingly no fruitful end. However, it is an extremely valuable experience that you can use for your future projects. The work of the BD team can still be used to answer similar questions in the future, and their experiences can help companies make decisions quickly and efficiently. While Evelyn's case study did not have a happy ending, it is the bittersweet reality of life and research. No matter what, you will always have value from your work and experiences.

This article was edited by Junior Editor Sonal Gahlawat and Senior Editor Shawn Rumrill.